pioneer status malaysia

V i e w p r o d u c t V i e w p r o d u c t. This article is relevant to candidates preparing for the Advanced Taxation ATXMYS exam.

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

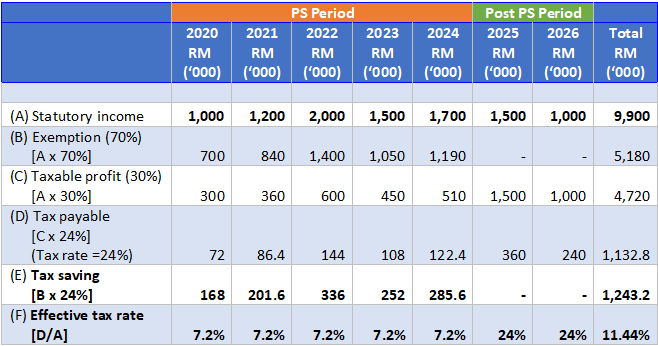

Only 30 of the income derived by a pioneer status company from promoted activities or promoted products is subject to the Malaysian corporate income tax currently 25.

. DXN received a 10-year pioneer status incentive on Spirulina cultivation and processing. Malaysia Pioneer Status. Although Malaysia is neither a tax haven nor a low tax jurisdiction for companies which are eligible for the tax incentives the effective tax rates may be significantly below the normal corporate tax rate of 24.

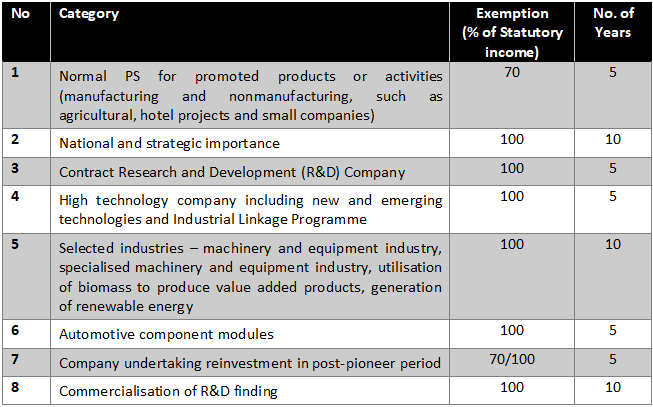

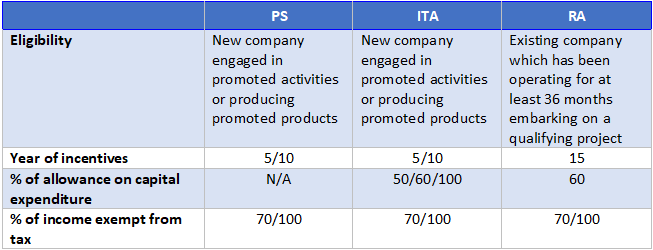

Application for pioneer status received on or after 111991 but before 1111991. Pioneer status often provides a 70 exemption of statutory income for a period of 5 years but it is possible to extend both the quantum and the period of the exemption. Pioneer Status Salient points.

Pioneer status is granted for an initial period of 5 years commencing from the production day as. This article collates and discusses the provisions in the Income Tax Act 1967 the Act and the Promotion of. Pioneer status and investment tax allowance are main tax incentives available from BKAT 3023 at Northern University of Malaysia.

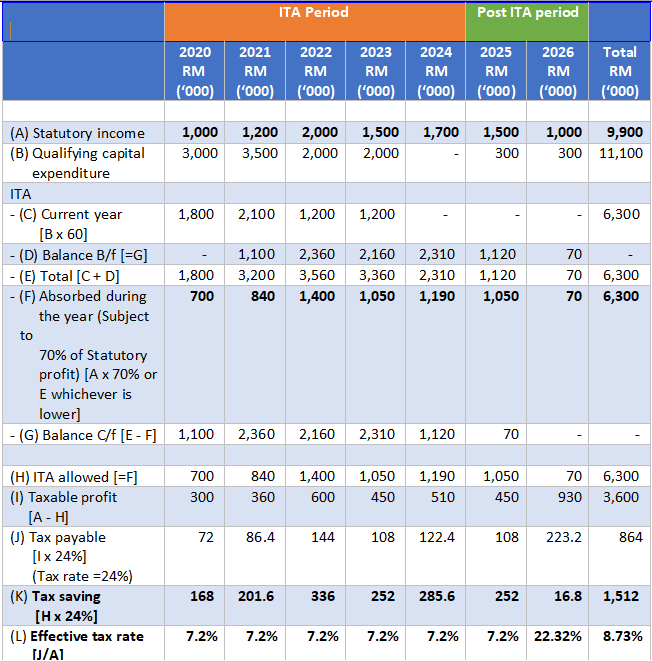

The alternative to pioneer status incentive is usually the investment tax allowance ITA. A company granted Pioneer Status PS enjoys a five year partial exemption from the payment of income tax. As this incentive has expired on 311200 extension of another 5 years until 311205 will be.

As a general rule income pioneer status companies derive from promoted activities or promoted products receives the following financial treatment. Application for Pioneer Certificate. MSC Malaysia status is recognized by the Government of Malaysia.

What is Pioneer company. Pioneer Status privilege granted with a five 5 five 5 year 100. LO SOLUTIONS SDN BHD - Pioneer Status Pioneer Status Tax ExemptionPioneer Status Kuala Lumpur KL Malaysia Selangor Negeri Sembilan Wangsa Maju Seremban Services We specialize in SME business loan machines properties loan P2P lending accounting audit services pre-bankruptcy planning etc.

Pioneer status investment tax allowance and reinvestment allowance. Pioneer Status is a status granted by The Malaysian Investment Development Authority with the aim to transform Malaysias best and most promising businesses into the most competitive enterprises in global export markets. While pioneer status is an income-based tax incentive investment tax allowance is a capital expenditure-based.

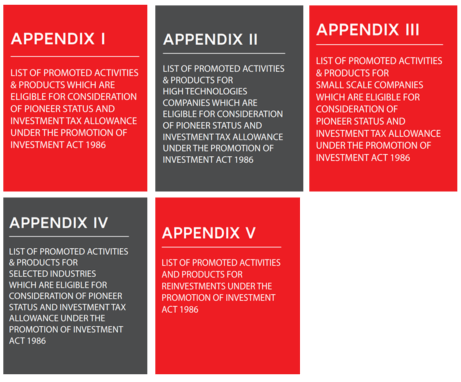

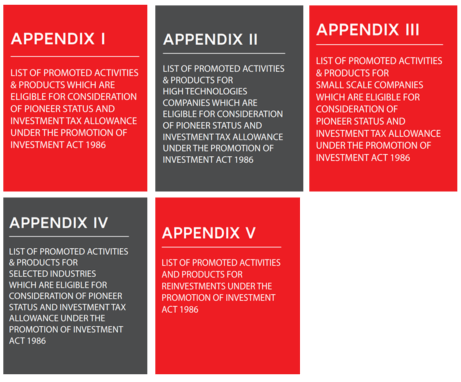

In Malaysia tax incentives both direct and indirect are provided for in the Promotion of Investments Act 1986 Income Tax Act 1967 Customs Act 1967 Excise Act 1976 and Free Zones Act 1990. Companies can now submit their applications for Pioneer Certificate and track its status online via InvestMalaysia Portal at investmalaysiamidagovmy. MSC Malaysia companies are eligible for incentives which include the.

The proposed investment incentives were to be offered to Fortune 500 companies and global. Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia. Application for Determination of Effective Date of the Investment Tax Allowance Incentive.

The article is based on the prevailing laws as at 31 March 2018. It may provide up to 10 years of tax holiday. The Hotel and Tourism Pioneer Status Application checklist was designed to be easy to use and is perfect for general managers tourism and hospitality site owners convention and visitors bureaus and others in the hospitality industry and tourism industry who are applying for Pioneer Status in Malaysia.

Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia. Pioneer Status PS The PS incentive is given in the form of direct exemption of profit from the payment of income tax for a period of 5 years certain companies are given 10 years up to 70 certain companies enjoy 100 of a companys statutory income income after deduction of allowable expenses and capital allowances. Pioneer Status PS is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10 years.

Investment tax allowance which grants you 100 deduction on capital qualifying expenditure that includes hardware and software and purchase or renovation of building and landscaping in Cyberjaya. A pioneer status which grants you 100 tax free on taxable statutory income for up to 10 years on MSC Malaysia Status approved qualifying activities. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of.

The Malaysian government extends a full tax exemption incentive of fifteen years for firms with Pioneer Status companies promoting products or activities in industries or parts of Malaysia to which the government places a high priority and ten years for companies with Investment Tax Allowance status those on which the government. Pioneer status by a company producing a product or participating in an activity of national and strategic importance to Malaysia. Is there any chance that company to extend their application of Pioneer.

Generally tax incentives are available for tax resident companies. DXN telah berjaya mendapat insentif bertaraf perintis selama 10 tahun dalam penanaman dan pemprosesan Spirulina. Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions.

ILS INCENTIVE IILS STATUS Pioneer Status - tax exemption 70 on statutory income 5 years Investment Tax Allowance 60 of qualifying capital expenditure 5 years Custom agent license ELIGIBILITY CRITERIA Locally incorporated 60 Malaysian Provide integrated logistics services Must OWN minimum assets. Tax exemption of statutory income for five years. Pioneer status often provides a 70 exemption of statutory income for a period of 5 years.

MSC Malaysia status is awarded to both local and foreign companies that develop or use multimedia technologies to produce or enhance their products and services as well as for process development. Pioneer Status PS is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products. Contoh menggunakan Pioneer status dalam ayat dan terjemahan mereka.

And Eastern Corridor of Peninsular Malaysia. These ICT and ICT-facilitated businesses can utilise the support of the Multimedia Development Corporation MDeC to develop or use multimedia technologies to produce and enhance their products and services.

Capital Allowance Computation Format

Pioneer Deq S1000a2 Universal Sound Processor Works With Factory Stereo Systems

Cyberjaya Infographics Real Estate News Infographic Everyone Knows

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Iscistech Business Solutions Malaysia Softwarecomany Malaysiancomany Itcompanymalaysia Itoutsourcingmalaysia Business Solutions Outsourcing Solutions

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Promoted Activities Mida Malaysian Investment Development Authority

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Vyrox Software Team Started Software Development Engineering Since 2008 Our Services Cover Smartphone Mobile Iot Smart Home App Development Software Projects

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

For Rent Vertical 2 Offices Bangsarsouth Msc Status Part Furnished Various Sizes Rm5 60psf Call 012 278 91 Property For Rent Rent Top Kitchen Cabinets

Comments

Post a Comment